HR Guide to Managing Payroll Processing Risks in a Multicultural Workforce in Singapore

Posted on 17 April 2024 in Business | Suki Bajaj

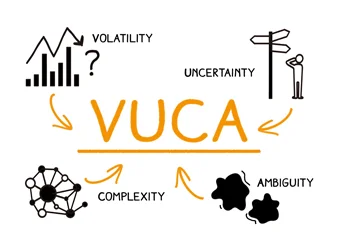

Singapore's vibrant economy thrives on its diverse talent pool. But managing a multicultural workforce brings unique challenges, especially in payroll processing.

From varying salary expectations to catering to different pay schedules, HR professionals have their hands full as they ensure accurate and compliant payroll processing for both local and foreign employees.

Here, we explore some common pitfalls and practical tips to ensure smooth payroll processing for your multicultural team:

Understanding Cultural Norms

Compliance Across Borders

Employment Pass and Work Permit Regulations

Social Security Contributions

Leave and Public Holidays

Taxation Complexities

Currency Fluctuations

Transparency in Compensation

Accuracy in Data Management

Cultural Sensitivity Training

Clear Communication

Empower Your Global Workforce with Compliant Payroll Processing

Get Started Today!Understanding Cultural Norms

Different cultures have varying expectations around pay structures, benefits, and tax implications.

Research common practices in your employees' home countries to avoid misunderstandings. For instance, some cultures prioritize bonuses, while others value fixed salaries.

Compliance Across Borders

Singapore has strict and comprehensive labour laws and tax regulations. Ensure you comply with the Employment Act's guidelines for both local and foreign employees.

Knowing your rights and responsibilities under the Act helps prevent legal issues and fosters a harmonious work environment for everyone.

Employment Pass and Work Permit Regulations

Different work passes have specific eligibility criteria and renewal processes. Ensure you obtain the appropriate work pass for your foreign employees.

Depending on the employee's nationality and work pass type, employers may need to pay Foreign Worker Levy (FWL) to the Ministry of Manpower (MOM).

Social Security Contributions

Familiarize yourself with the Central Provident Fund (CPF) contribution requirements for different employee categories, especially those with dependents overseas.

Both employers and employees contribute a mandatory percentage of monthly salary to the CPF. Be sure to stay informed about the current contribution rates and eligibility criteria.

Leave and Public Holidays

Be mindful that employees may have different expectations around leave entitlements. Some cultures have specific religious holidays not observed in Singapore. Clearly communicate your leave policy and public holiday schedule.

Taxation Complexities

Employees from different countries have different tax residency statuses or claim tax deductions unfamiliar to the Inland Revenue Authority of Singapore (IRAS).

The length of stay and work visa type can affect an employee's tax residency status, impacting tax rates and deductions.

Make sure to comply with regional tax regulations and follow the tax filing deadlines and residency implications to ensure proper deductions and avoid penalties.

Currency Fluctuations

For employees paid in foreign currencies, currency fluctuations can impact their take-home pay.

Consider offering options like fixed exchange rates or cost-of-living adjustments to maintain employee morale.

Transparency in Compensation

Address potential cultural differences in salary expectations. Foster open communication about compensation and benefits’ structures and payroll processing policies to avoid misunderstandings.

Accuracy in Data Management

Maintaining accurate employee data is paramount. Double-check details like names, bank accounts, tax identification numbers, and visa status to avoid errors in payslips and remittances.

Cultural Sensitivity Training

Invest in cultural sensitivity training for your HR team to foster understanding and appreciation for diverse working styles.

This will help to effectively navigate the differences around cultural backgrounds, communication styles, and decision-making processes. This way, they can ensure that payroll policies and practices are fair and equitable for everyone.

Clear Communication

Clearly communicate payroll policies and procedures including pay schedules, benefits details, and tax deductions, catering to the diverse workforce.

Regularly review and update employee handbooks or employee database to reflect any changes. This fosters trust and reduces confusion.

Navigate Payroll Risks in Your Diverse Workplace in Singapore

Managing a multicultural payroll processing in Singapore doesn't have to be stressful. With QuickHR Payroll Software, you can handle complexities with confidence, ensuring a smooth and compliant payroll experience for both your company and your employees.

Effortless Accuracy

- Integrates with HR processes (leave, attendance, claims, scheduling)

- Automates calculations and submissions (CPF, Bank GIRO, IRAS)

- Employee self-service portals for accessing payslips, updating personal info and submitting leave requests

- Mobile app for managing payroll and other HR tasks on-the-go

Flexibility and Informed Decisions: Remote-Ready for Modern Workplace

- Generates multilingual payslips for clear communication

- Adapts to company policies and employee needs (full-time, part-time, freelance)

- Handles various pay cycles (monthly, bi-monthly, daily, ad-hoc)

- Provides comprehensive reports (payroll summaries, trends)

Always Compliant

- Up-to-date with the latest MOM, CPF & IRAS requirements

- IRAS-approved vendor for AIS submissions

- Generates and submits forms electronically

By offering seamless integration, flexible solutions, and robust compliance features, QuickHR ensures accurate, efficient payroll processing for a diverse workforce.

Enjoying this content? Subscribe and we’ll send the latest updates and special offers directly to your inbox.