HR's Guide to Foreign Worker Levy (FWL) in Singapore: Know about Check and Pay Foreign Worker Levy & Foreign Worker Levy Waiver

Updated on 18 January 2024 in Business | Suki Bajaj

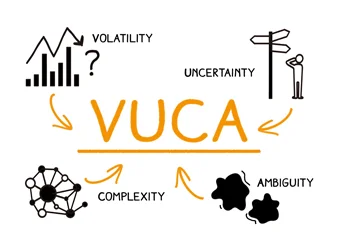

As Singapore's economy recovers from the pandemic, businesses are in hunt for the world's best and brightest foreign talents in response to pressing hiring needs

during a labour crunch. In the advent of what has been labelled as the "global war for talent", it's now more important than ever for HR professionals to further explore the strict policies and guidelines surrounding Foreign Worker Levy.

In this article, we'll discuss everything you need to know about Foreign Work Levy and how you can maintain regulatory compliance when managing global talents.

Streamline foreign worker levy payments with QuickHR MOM-Compliant Payroll Software!

Get Started Today!What is Foreign Worker Levy (FWL)?

Every year, Singapore receives an enormous amount of foreign job applicants from all around the world. This causes a problem for local citizens and Permanent Resident (PR) holders due to the rising competition for jobs.

Therefore, the government established the Foreign Worker Levy (FWL) mechanism to keep the number of foreign employees or work permit holders in check.

Employers are required to pay the monthly levy that applies to Work Permit and S Pass holders. The levy’s eligibility starts on the day the Work Permit or the Temporary Work Permit is issued, and ends on the day the permit expires or is cancelled. [1]

What is Dependency Ratio Ceiling?

The Dependency Ratio Ceiling (DRC) is another mechanism introduced by the government to regulate the intake of migrant workers.

A dependency ratio ceiling, or quota, is the maximum ratio of foreign employees who are permitted to join a company’s workforce. This ratio varies based on the specific sector, and is often subject to changes. [1]

For instance, the quota for the manufacturing sector is 60%. Therefore, up to 60% of a manufacturing company’s total workforce (including local workers, S Pass and Work Permit holders) may consist of S Pass and Work Permit holders.

Click here to find out the levy requirements by sector.

How is Foreign Worker Levy Calculated?

The levy rate and quota for businesses generally depend on two factors:

- The worker’s qualifications

- The number of Work Permit or S Pass holders hired

Note: Levy rates are regularly reviewed and adjusted as required. Check the upcoming levy rates for the construction and process sectors that will be effective from 1 Jan 2024. [1]

You may also calculate the levy quota here.

When and How to Pay the Foreign Worker Levy in Singapore?

HR managers must pay the monthly levy via General Interbank Recurring Order (GIRO). However, for new employers who are in the process of applying for a GIRO arrangement, payment can be temporarily made via PayNow QR. [2]

Employers may apply for a GIRO account using the GIRO application form. Once GIRO is approved, the levy for each month will be deducted from the bank account on the 17th of the following month (or the next working day if it falls on a weekend or public holiday). For instance, the levy for August will be deducted on 17 September.

Therefore, always remember to maintain sufficient funds in the bank account before the deduction date. Keep in mind that if the GIRO deduction is unsuccessful, the bank may charge a failed transaction fee.

Note: Due to system changes, the first GIRO deduction will only take effect from January 2023 onwards. The employer will be notified of the first GIRO deduction date via email.

If there’s a need to pay the levy using other methods, it must be paid for each month by the 14th of the following month.

Other payment methods must not be used if the employer already has a GIRO arrangement, as the scheduled GIRO deduction will still go ahead.

To know more about the payment process for Foreign Worker Levy, click here.

How Do I Check the Foreign Worker Levy Bills?

To make it easier and more convenient, HR managers may check the monthly levy bill on the 6th of every month via MOM’s eService. Click here and log in with Singpass account to view the latest levy bill.

Is There a Foreign Worker Levy Waiver in Singapore?

Employers can get a waiver for their foreign worker levy payments if they meet the eligibility criteria, and only under certain specific situations such as overseas leave and hospitalisation leave.

Click here to apply for a foreign worker levy waiver.

Take note that the application for a waiver must be submitted within one year after the FWL has been charged. For instance, if the waiver period requested is from January 2016 (start month) to February 2016 (end month), the employer must submit the application by 31 January 2017. [3]

To know more about the levy waiver and rebates that are part of the COVID-19 support measures, click here.

Can I Apply for a Refund?

HR managers may apply for a refund if the FWL has been paid in excess and no longer need to pay FWL. [4]

The application for a refund must be submitted within one year from the date of payment. Click here to apply for a refund.

To keep track of the application status, click here.

Is There a Penalty for Not Paying the Foreign Worker Levy?

If the employer wasn’t able to pay the full levy on time, they may face the following penalties: [2]

- A late payment penalty of 2% per month or $20, whichever is higher. The total late payment penalty will be capped at 30% of the outstanding levy.

- The existing Work Permits will be cancelled.

- The employer won’t be allowed to apply for or issue Work Permits, or renew existing Work Permits.

- The employer may face legal action to recover the unpaid levy.

- If the employer or the partners or directors head other companies, these companies may not be allowed to apply for Work Permits.

You may calculate the foreign worker levy penalty here.

Conclusion

Hiring global talents can be a tough and time-consuming process. Let us help you manage your foreign worker levy payments with QuickHR’s all-inclusive and fully compliant payroll software that offers tailored processes based on your company’s policies and employees’ unique requirements.

To know more about QuickHR, you may reach out to us or you may instantly start your 14-day free trial!

- [1] https://www.mom.gov.sg/passes-and-permits/work-permit-for-foreign-worker/foreign-worker-levy/what-is-the-foreign-worker-levy

- [2] https://www.mom.gov.sg/passes-and-permits/work-permit-for-foreign-worker/foreign-worker-levy/paying-the-levy

- [3] https://www.mom.gov.sg/passes-and-permits/work-permit-for-foreign-worker/foreign-worker-levy/apply-for-levy-waiver

- [4] https://www.cpf.gov.sg/employer/employer-obligations/foreign-worker-levy

Enjoying this content? Subscribe and we’ll send the latest updates and special offers directly to your inbox.